Hi! Welcome to EU Weekly, your go-to newsletter to stay on top of all EU news. Our publication is also available in French, Spanish, Italian, Romanian, Russian, and Ukrainian.

Feel free to share this newsletter with friends and colleagues.

EU takes Goliath to WTO over David Dispute

The European Union is taking China to the World Trade Organization (WTO) over its retaliatory trade measures against Lithuania.

DAVID V. GOLIATH • Relations between Lithuania and China have deteriorated sharply in the last months. Since December 2021, Lithuania is subject to — unofficial — retaliatory trade measures, following its departure from the 17+1 cooperation forum set up by Beijing, and the opening of a representative office of Taiwan — not Taipei. The de facto boycott has caused a 91% drop in Lithuanian exports to Beijing.

China’s restrictions not only hit imports from Lithuania but also products containing Lithuanian components, which takes a toll on many other EU companies. It quickly made the conflict an EU-wide trade issue, infuriating the Federation of German Industries (BDI), a lobby group for the country’s powerful export sector.

WTO SLINGSHOT • After looking for alternative solutions, the 27 finally decided to refer the matter to the WTO. The EU was also patient for fear of alienating Member States — such as Germany — which considered that Vilnius had “needlessly provoked” Beijing.

For Brussels, Beijing's actions are clearly "discriminatory and illegal under WTO rules". Even if Lithuanian exports to China represent a limited amount — 300 million euros, i.e. 1% of total Lithuanian exports —, it is the very principle of these practices that is not acceptable to the EU, which sees them as a direct attack on its single market.

RIDICULOUS? • Trade Commissioner Valdis Dombrovskis stressed how serious the EU is about the case: "Launching a WTO case is not a step we take lightly. However, after repeated failed attempts to resolve the issue bilaterally, we see no other way forward than to request WTO dispute settlement consultations with China”.

The Wall Street Journal made light of the move: “Talk about bringing a quill pen to a gunfight”, while Politico suggested it ”gives China a nudge rather than a slap”. The WTO is indeed not the place for the speedy resolution of disputes, and international trade law is not particularly well equipped to deal with economic coercion.

BETTING ON THE EU • For former WTO Director-General Pascal Lamy, the current situation is the result of "a trade measure decided by China, but there is no commercial reason to do so, it is a political weapon of trade". "If the EU wins the case, which it probably will, China will have to remove the measure" or the EU can impose retaliatory measures such as tariffs, Lamy says. Several countries — among which the US, Australia, and the UK — came out in support of the EU.

NEXT STEPS • Consultations will last 60 days, after which the EU may take the case to an adjudication panel if discussions with China do not bear fruit. If an adjudication panel were to happen, the burden of proof would be a high one.

Under WTO rules, the Commission would have to prove that the widespread blocking of Lithuanian goods by Chinese customs is attributable to government policy imposed by Beijing. China denies that it is applying a sanctions regime, as the channels used are unofficial: error messages on customs websites, order cancellations by Chinese companies.

PATIENCE • The WTO case has no chance of succeeding in the short term. The Anti-Coercion Instrument (ACI) — a new trade mechanism designed to slap tariffs on third countries wielding pressure on EU Member States — could prove to be a more actionable slingshot for the EU than WTO lawsuits. However, it has not been adopted yet, and negotiations should last several more months.

Fines, Inquiries, Ultimatums, and a Clearance — a Week in the EU for Big Tech

EXPENSIVE COOKIES • France’s Conseil d’État — the supreme administrative court — confirmed on 28 January a record 100 million euros fine imposed on Google by the country’s privacy watchdog in December 2020. France’s CNIL hit Google with a fine over its cookie policy. Google’s cookies automatically track users without providing the “clear and complete” information required by the EU’s General Data Protection Regulation (GDPR), the CNIL contended.

Cookies are proving an expensive matter in France for Alphabet’s unit. On 31 December 2021, CNIL slapped Google with a 150 million euro fine — yet another record — for the “biased design” of its cookies. With its decisions, CNIL has finally laid down a guiding principle, namely, that the complete refusal of cookies should be “just as easy” for users as their complete acceptance.

CLOUD INQUIRY • On 27 January, the French Competition Authority launched an investigation into the cloud computing sector in France and the EU. It will hold a broad public consultation around the summer to gather comments from all stakeholders.

The newly appointed president of the French Competition Authority, Benoit Coeuré, announced his intention to focus on "the emergence of new essential infrastructures such as the cloud" during his confirmatory hearing at the National Assembly on 12 January. The final conclusions of the sector inquiry will be released in early 2023. Cloud computing is a key plank in European plans to reinforce the block’s “strategic autonomy”, with projects such as GAIA-X aimed at making the EU less dependent on US technology.

META CLEARANCE • On 27 January, the European Commission approved the acquisition of the customer-relationship-management (CRM) software company Kustomer by Meta (Facebook) — conditional on access commitments.

To win approval, Meta committed to grant CRM competitors non-discriminatory access to its messaging channels — which include Messenger, Instagram, and WhatsApp. Meta also made a “core API access-parity commitment”. For non-geeks, this means that Meta pledges “not to cut off access to or freeze the competition’s ability to keep pace with its messaging platforms’ feature sets” according to Natascha Lomas, from TechCrunch.

The attention of antitrust enforcers is shifting towards merger regulations on both sides of the Atlantic. In March 2021, the European Commission launched a reform of its Merger Regulation — to allow National Competition Authorities to refer cases to the Commission even when they don’t meet the EU’s turnover thresholds. This possibility, now contained in Article 22 of the EU Merger Regulation, was used in the Kustomer / Meta deal.

The FTC and the DoJ announced in January 2022 their plan to strengthen enforcement against “illegal mergers” in a move to prevent Big Tech from going under the radar in “killer acquisitions” of high-value and low-turnover companies.

WHATSAPP ULTIMATUM • The European Commission sent a letter to WhatsApp on 27 January, asking the company to “clarify the changes it made in 2021 to its terms of services and privacy policy and ensure their compliance with EU consumer protection law”.

Last year, WhatsApp faced a huge backlash over its opaque new terms of services — with consumer organization BEUC leading the charge. The EU gives WhatsApp one month, until the end of February, to explain how they will address the Commission’s concerns about the sharing of user data and the clarity of information for users.

Commissioners Disagree Over Nuclear and Gas in Green Taxonomy Proposal

The European Commission is due to adopt its position on the last delegated act of the upcoming Green Taxonomy. Divisions among the College of 27 Commissioners have arisen, with two Commissioners among the last officials to make their disagreements public. The labyrinthine specifics of the delegated act are a highly radioactive topic in Brussels.

CONTEXTO • The Taxonomy Regulation was adopted in 2020 to give EU-wide “criteria for determining whether an economic activity qualifies as environmentally sustainable”. This has huge implications for sustainable investment, as private funds will flow into categories deemed sustainable by the EU’s rulebook.

The precise list of sustainable activities was not decided upon straight away in the regulation but left to delegated acts. The Commission has to “come up with the actual list of environmentally sustainable activities by defining technical screening criteria for each environmental objective” — under the eye of parliamentarians and experts sent by the Member States. The classification of nuclear and gas was always going to be a controversial exercise - which is why it’s being dealt with last.

HAHN NO • EU Budget Commissioner Johannes Hahn announced on 25 January that he will vote against the draft delegated act to recognise nuclear energy and natural gas as economic activities contributing to climate change adaptation or mitigation. This is the first time that the College of Commissioners has publicly been divided on the issue.

Hahn denounced the timetable laid down in the draft delegated act. As it stands, it provides that permits to build power plants can be granted until 2030 for gas and 2045 for nuclear. This means being dependent on nuclear power for almost another century, according to the Commissioner.

YES MCGUINNESS • Against this backdrop, Financial Services Commissioner Mairead McGuinness sent a pro-nuclear-and-pro-gas message in an interview with Politico’s Brussels Playbook on 31 January. The Irish Commissioner stresses “tweaks rather than rewriting” were to be expected, as the Commission as a whole supports the inclusion of gas and nuclear in the taxonomy.

TRENCH WAR • Several MEPs have signed letters to the European Commission. One letter has attracted widespread attention — it is signed by the two rapporteurs of the Taxonomy Regulation. They believe that the draft delegated act sent to the Member States on 31 December does not comply with the spirit of the regulation.

The Sustainable Finance Platform, which advises the European Commission on the drafting of delegated acts relating to the taxonomy regulation, considers that gas and nuclear should not be considered as transitional energies.

While France pushes for the inclusion of nuclear energy, Germany made its pro-gas-anti-nuclear stance clear last week. The anti-nuclear and pro-Nord Stream 2 members of the new ruling coalition in Berlin have to strike a balance between conflicting interests.

NEXT STEPS • It is unlikely that the delegated act faces defeat once the Commission has adopted its position. A reverse qualified majority of 20 Member States out of the EU’s 27 is needed to block the text at the Council.

Intel’s Chip and Charge Against Antitrust Fine Secures a Win

In a final act of the Intel antitrust saga, the General Court of the European Union, ruling on a referral from the Court of Justice of the European Union (CJEU), annulled the Commission's 2009 decision by which it had imposed a fine of more than one billion euros on Intel.

CONTEXTO • The Commission fined the US semiconductor manufacturer for abuse of a dominant position, accusing it of having granted loyalty rebates to four computer manufacturers. The Commission's decision was initially upheld by the General Court, but that judgment was subsequently annulled by the CJEU. Taking the view that the General Court had not taken account of Intel's argument that the practices at issue did not have the capacity to produce crowding-out effects on its competitors, the CJEU referred the dispute back to the General Court.

EFFECTS-BASED APPROACH • The General Court held that the Commission's analysis was “incomplete” and that it had not sufficiently established the ability of each of the rebates to produce anti-competitive effects. As Pablo Ibanez Colomo explains, this decision reminds us that the assessment of the effects of practices in European competition law is not just a formality.

REACTIONS • This is a setback for the Commission. Margrethe Vestager announced that her teams will study the decision in detail, as well as the lessons to be learned. On the other hand, Intel welcomed the decision and said the semiconductor industry has never been as competitive as it is today. The European Consumers' Organisation (BEUC) expressed its disappointment at the outcome of the judgment and called for an urgent acceleration of antitrust proceedings. The judgment of the General Court may still be appealed to the Court of Justice of the EU.

CHIP AND CHARGE • One man is happy. The timing of the Court’s decision is perfect for Internal Market Commissioner Thierry Breton — who announced on 31 January in the German and French media, in support of the draft Chips Act which should be presented on 8 February, that "Europe must be the leader of the next generation of chips". His ambition is to quadruple chip manufacturing in the EU so that it reaches 20% of world production by 2030.

EU to Target Russian Energy Sector if Ukraine Conflict Escalates

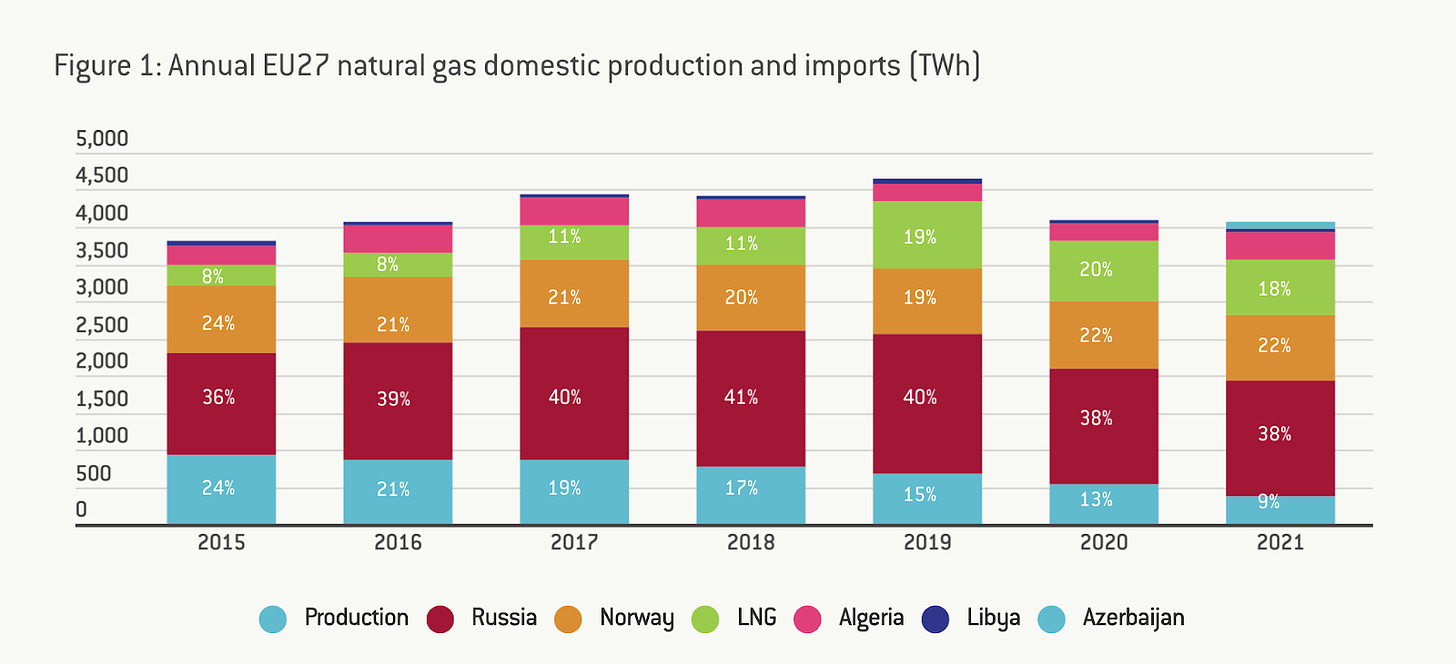

The EU is threatening to block the transfer of funds and technology towards new Russian gas projects in the event of an invasion of Ukraine. The ideal of European strategic autonomy is still remote when it comes to fuel, however: 40% of the EU's fuel needs are met by Russian imports.

ROLLER COASTERS • The US is taking the Ukraine matter to the UN Security Council, and together with Brussels, has announced sanctions in the event of an armed offensive by Russia.

Already the world's largest exporter of natural gas and the EU's largest supplier, Russia is now turning to liquefied natural gas (LNG), with which it hopes to conquer Asian markets. If it invades Ukraine, however, it risks seeing its ambitions slowed down by the slew of European sanctions which could then be imposed: the suspension of European technology transfers, investments, and technical assistance. The Nord Stream 2 pipeline would also be imperilled — Washington believes it would be aborted in the event of an invasion.

FRIENDLY DISAGREEMENTS • The response to the Russian deployment, and in particular the possibility of sanctions, is a major bone of contention within the Atlantic alliance. Germany has banned Estonia from exporting arms to Ukraine, a decision openly criticised by British Foreign Secretary Liz Truss and Polish Prime Minister Mateusz Morawiecki. Like Paris, Berlin continues to call for dialogue to find a way out of the crisis. The cancellation of Nord Stream 2 would be a major setback, after years of resisting US pressure.

HEAT UP • In a blog post, Bruegel explored the energy-related "worst-case scenario" of the crisis with Russia. The authors conclude that the EU would only be able to meet its gas needs until the summer if Moscow turns off the tap. Energy Commissioner Kadri Simson said last week that she would attend conferences in Azerbaijan and Washington in February to discuss ways of increasing gas supplies to Europe, to mitigate the risk from Russia.

UNCLE SAM HELPS • The EU and the US are meeting in Washington next Monday for an Energy Council. A joint statement, issued by Joe Biden and Ursula von der Leyen on 28 January, stresses that the EU’s energy supply diversification is top of the agenda.

“We intend to work together, in close collaboration with EU Member States, on LNG supplies for security of supply and contingency planning. We will also exchange views on the role of storage in security of supply the statement reads” — Joint Statement, 28 January

What we’ve been reading this week

Adam Tooze reviews Luuk van Middelaar’s latest book in the New Statesman, and ponders : Can Europe Tame Pandemonium

China’s Digital Power, a fascinating report edited by think-tankers and academics from 9 countries.

The Delors Centre’s Thu Nguyen and Nils Redeker released a paper on the links between the European Semester and the Resilience and Recovery Facility (RFF) — or how to make the marriage work

A must-read-big-read by the Financial Times: Does the EBRD still finance freedom? Big Read

A very interesting piece by Christopher Mims for the Wall Street Journal, on How the FTC Is Reshaping the Antitrust Argument Against Tech Giants, which can be read before or after (your choice) this paper in defence of the consumer welfare standard by The Economist

Bruegel’s policy paper, which we mentioned above, asks Can Europe survive painlessly without Russian gas

Thanks to those who helped put this edition together — Bérangère Maurier, Battiste Murgia, Dana Fedun, Kéram Kehiaian, Mark Soler, Briac de Charry, Maxence de La Rochère, Rogier Prins, Agnès de Fortanier and Thomas Harbor. See you next week!